In the dynamic landscape of business operations, the importance of strong internal financial control cannot be overstated. As a leading digital marketing agency, we recognize the critical role that Entity-Level Internal Financial Control plays in shaping the financial integrity of organisations. This page delves into the significance of Entity-Level IFC, its implementation, and how Vibrant can assist your business in fortifying its financial governance.

What is it?

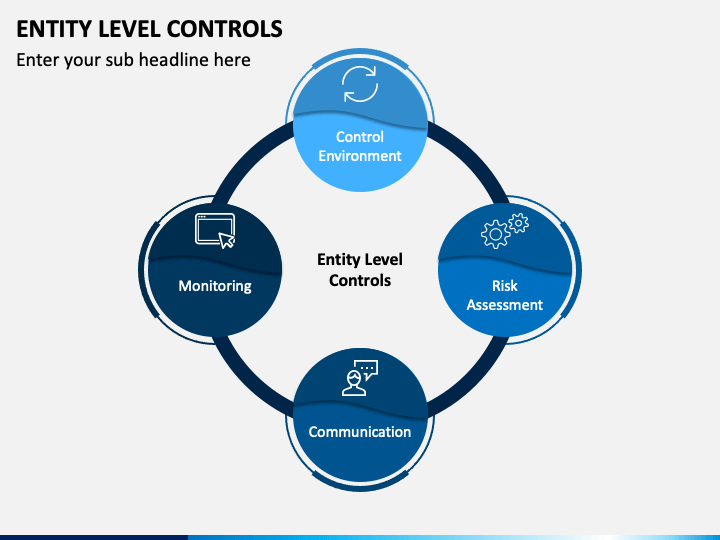

Entity-Level IFC (Internal Financial Control) refers to the overarching control environment established by an organisation’s leadership. This is done to ensure the reliability of financial reporting, compliance with laws and regulations, and the effectiveness of operations. These entity-level controls are pervasive and impact the entire organisation. As a result, we work hard to set the tone for ethical conduct, risk management, and accountability, creating a foundation for a robust internal control system for your business.

Key Aspects of Entity-Level IFC:

- Leadership Oversight: Effective Entity-Level control begins with a strong leadership commitment to ethical conduct, transparency, and financial stewardship. It involves setting the tone from the top and establishing a culture of integrity that extends throughout the organisation.

- Risk Assessment: A comprehensive risk assessment at the entity level is crucial. This involves identifying and evaluating potential risks that could impact financial reporting or compliance. Understanding these risks allows for the development of controls to mitigate and manage them effectively.

- Information and Communication: Efficient communication channels are vital to Entity-Level IFC. Clear communication of financial policies, procedures, and expectations ensures that all stakeholders are aligned with the organisation’s financial objectives and compliance requirements.

- Monitoring Activities: Continuous monitoring is essential for assessing the ongoing effectiveness of Entity-Level controls. This includes regular evaluations, internal audits, and reviews to ensure that the control environment adapts to changes in the organisation’s structure, operations, and external environment.

Our services

In the complex world of financial management, achieving excellence requires more than just observance of regulatory norms. It demands a strategic approach to internal financial control at the entity level. As a seasoned financial consultant, we understand the significance of Entity-Level Internal Financial Control (IFC) in fortifying financial governance.

- Thorough Assessments: Our consultants conduct comprehensive assessments of your current Entity-Level Internal Financial Control systems. We identify strengths, weaknesses, and opportunities for improvement, providing a roadmap for enhancement.

- Strategic Planning:Collaborating closely with your leadership, we develop a strategic plan for reinforcing Entity-Level controls. This plan aligns with your business objectives, ensuring a seamless integration of financial governance and strategic goals.

- Training Programs: We recognize the importance of ensuring that your team comprehends the significance of Entity-Level IFC. Our training programs equip your staff with the knowledge and skills needed to uphold these controls effectively.

- Continuous Monitoring and Reporting: BKP consultancy services include continuous monitoring, coupled with detailed reporting. This ensures the ongoing effectiveness of Entity-Level controls, adapting to changes in your business environment, and maintaining compliance with evolving regulations.

As your trusted financial consultants, we understand the pivotal role Entity-Level Internal Financial Control plays in shaping your organisation’s financial destiny. Elevate your financial governance to new heights with our tailored solutions. Partner with us, and let’s navigate the path to financial excellence together, ensuring a resilient foundation for your business growth.